Document ID: SIR-2026-HE-001-REV

Structural Status Reading: Absolute Time Sovereignty / Extreme-Parameter Stability

I. System Observation Statements

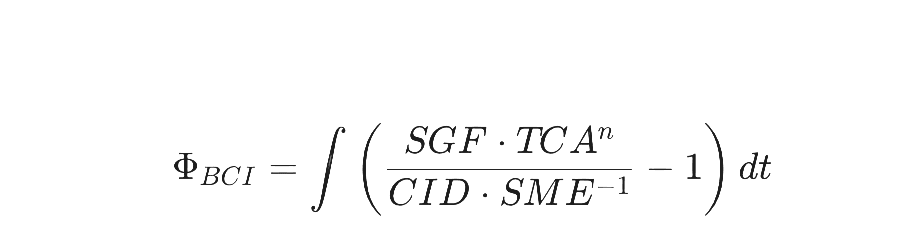

According to the BCI Protocol V1.0,

Hermès exhibits a premium-generation mechanism anchored in Temporal Non-Efficiency.

Structural observations confirm that where unavailability is institutionally embedded across production and allocation, premium formation does not derive from scale efficiency but from the stability of the Temporal Structure (TS).

The current Perceptual Legibility (PL) reading of 1.45 represents a rare state of high-friction access. This low legibility is a primary defense mechanism, ensuring that the asset remains cognitively “opaque” to non-custodial demand. The Meaning Tension (MT) remains at 9.82, indicating that symbolic attraction is sustained by the deliberate suppression of delivery speed.

BCI Structural Matrix — Institutional Calibration

| Dimension | Reading | Institutional Definition | Financial Mapping |

| MT (Meaning Tension) | 9.82 | Pulse Gravity | Goodwill / Customer LTV |

| PL (Perceptual Legibility) | 1.45 | Cognitive Friction | Gross Margin Stability |

| TS (Time Structure) | 9.91 | Non-Linear Accumulation | Discount Rate / ROIC |

| ES (Energy State) | 9.15 | Metabolic Efficiency | SG&A / Craft Retention |

II. Governance Option Descriptions

The following pathways describe methods for the continued maintenance of the asset’s structural integrity under industrial pressure:

- Efficiency Logic Calibration: Describes the monitoring of labor hours per core SKU. If efficiency gains reduce labor input by >10%, this option involves a reassessment of the potential decay in TS and PL, as short-term cash flow gains may compromise long-term temporal premium.

- Capital Asset Protection (Sovereignty Reserves): Describes the explicit disclosure of risks associated with reduced investment in artisan training or raw-material reserves. Within this framework, elevated Days Inventory Outstanding (DIO) is recognized as a necessary cost of temporal stability rather than an operational anomaly.

- Cognitive Decoding Management: Describes the use of “archival narratives” or “limited series” to release structural tension. This option prioritizes reduced information completeness and higher decoding thresholds over expanded market reach to stabilize MT and PL readings.

III. Scenario Tree Simulations

- Path Alpha (Structural Continuity): Under current governance logic, temporal premium mechanisms remain stable. The asset continues to exhibit the highest resilience percentile in the BCI peer universe.

- Path Beta (Industrial Encroachment): If scale expansion erodes physical and cognitive friction, the TS may shift from exponential to linear accumulation, requiring the immediate implementation of pre-set capacity constraints.

[ 🔒 AUTHORIZED ACCESS ONLY ]

Download Full SIR-2026-HE-001-REV Report (PDF)

BCI Institutional Grade Seal | Restricted Distribution