Document Ref: SIDR-2026-AM-004-REV

Audit Standard: BCI-Sovereign-S1-2026

Structural Status Reading: Urbanization Stress / Spatial Pulse Calibration

I. System Observation Statements

Based on the BCI Protocol V1.0, Aman’s structural integrity is currently undergoing a “Spatial Sovereignty Stress Test.”

The system observes that Aman’s historical premium—anchored in physical remoteness—is being translated into a replicable commercial symbol through urban expansion.

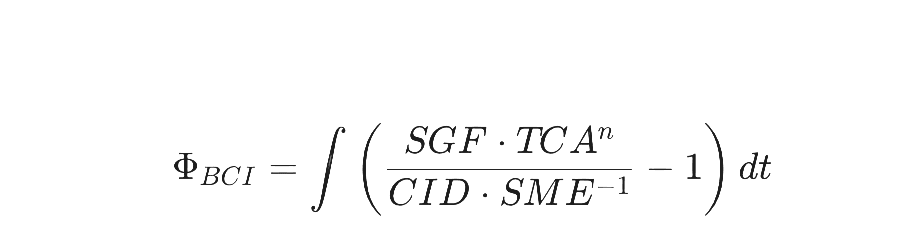

The current Meaning Tension (MT) remains robust at 9.72, driven by an architectural coherence that maintains a “Silent Premium” among ultra-high-net-worth cohorts. However, the Energy State (ES) has decelerated to 7.40, signaling high operational load and potential systemic exhaustion amid the dual pressures of urban flagships and the global rollout of the sister brand, Janu. Structural friction is emerging where urban accessibility threatens to increase Perceptual Legibility (PL) beyond the sovereign threshold of 5.5.

BCI Institutional Matrix — Current Readings

| Dimension | Reading | Institutional Definition | Financial Mapping (CFO Focus) |

| MT (Meaning Tension) | 9.72 | Symbolic Gravitational Pull | Brand Goodwill / RevPAR Premium |

| PL (Perceptual Legibility) | 4.80 | Controlled “Illegibility” | CAC / Secondary-Market Exclusivity |

| TS (Time Structure) | 9.85 | Spatial Anti-Decay | Residual Asset Value / CapEx |

| ES (Energy State) | 7.40 | Metabolic Efficiency | Operating Margin / Talent Attrition |

II. Governance Option Descriptions

The following pathways are mapped to stabilize the asset’s structural autonomy during the urbanization phase:

- Urban Narrative Isolation: Describes the enforcement of stricter cognitive barriers for urban assets compared to remote resorts. This option involves raising access thresholds for non-resident services (F&B/Spa) if they exceed 30% of revenue, preventing the asset from defaulting into a mere “display window.”

- Janu Risk Isolation Wall: Describes a financial and communicative decoupling of the Janu brand from Aman’s core system. This path ensures that Janu’s growth velocity does not extract from Aman’s MT, treating any decline in core NPS as a cross-brand capital misallocation.

- Visual Information Downscaling: Describes a deliberate reduction in high-definition panoramic exposure. By returning to partial narratives and stream-of-consciousness signaling, governance can increase PL resistance, filtering out low-net-worth social followers in favor of high-conviction peers.

III. Scenario Tree Simulations

- Path Alpha (Sovereignty Preservation): Successfully translates “Physical Remoteness” into “Psychological Isolation.” Under this path, Aman remains an anchor for top-tier real estate premiums with AAA-grade integrity.

- Path Beta (Commercial Erosion): Absent exceptional cognitive resistance, the brand risks converging toward conventional luxury hospitality models. This necessitates the contraction of public-area openness to counter PL inflation.

[ 🔒 AUTHORIZED ACCESS ONLY ]

Download Full SIDR-2026-AM-004-REV Report (PDF)

Institutional Password Required. Structural Diagnostic Review.

BCI reports are designed to be cited for institutional risk discussion and governance analysis.Full attribution to BCI Lab – Structural Governance Framework is required.