Institutional Summary | Structural Snapshot

- Document Ref: SAR-2026-LOE-006-V3

- Audit Standard: BCI Structural Integrity Protocol (BSIP) v2.0

- Asset Base Classification: Experimental Autonomy

- Service Tier: Category A – Structural Snapshot

- Data Reliability Grade (DRG): Grade A (Institutional Grade)

- Data Cut-Off Date: 2026.01.31

1. Strategic Anchor

The asset structure of Loewe is currently categorized as Experimental Autonomy. Its structural differentiation is anchored in the institutionalization of craft-intellectual capital through foundation-linked initiatives and a disciplined experimental design narrative.

Unlike peers driven solely by seasonal trends, Loewe demonstrates a high degree of internal coherence by coupling contemporary creative cycles with legacy asset integration.

2. Quantitative Structural Mapping

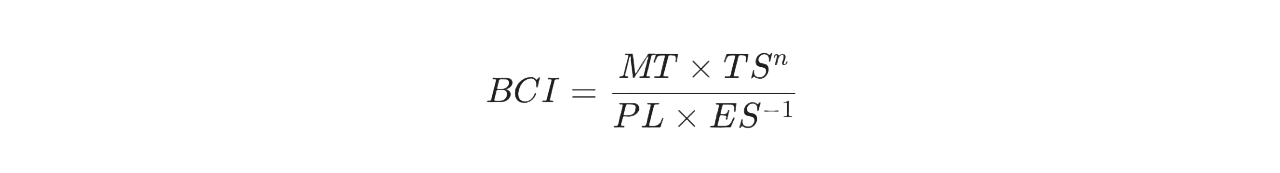

The asset’s premium power is quantified via the BSIP v2.0 universal engine:

BCI Score: 8.78 ± 0.15 (Confidence Band: 95%)

| Dimension | Reading | Institutional Definition | Financial Mapping (CFO Interface) |

| MT (Meaning Tension) | 9.1 | Institutionalization of craft-intellectual capital. | Goodwill stability / Client retention. |

| PL (Perceptual Legibility) | 7.8 | Iconographic consolidation (Core codification). | Gross margin protection / Pricing power. |

| TSⁿ (Time Structure) | 8.5 | Legacy asset integration with creative cycles. | Residual value preservation / LTV. |

| ES⁻¹ (Energy State) | 9.2 | Purity of systemic symbolic circulation. | Retail efficiency / Operating margin. |

Disclaimer: All readings are internal methodological references for structural diagnostic purposes only.

3. Trajectory & Structural Diagnostics

- Status Reading: High Expansion Synchronization Phase.

- System Observation: The system identifies synchronized elevation in Meaning Tension (MT) and Energy State (ES). No structural impairment indicators are detected within current variance tolerance bands.

- Quadrant Classification: Experimental Autonomy (Taxonomic Descriptor).

4. Legal & Governance

- Rating Limitation Clause: This document does not constitute a credit rating, securities analysis, valuation report, or investment recommendation.

- Reassessment Triggers:

- Material Creative Leadership Transition: Shift in primary narrative authority.

- Pricing Realignment Event: Sustained deviation exceeding ±1.5x quarterly variance.

- Structural Energy Contraction: ES reading below sector median for two reporting periods.

- Jurisdictional Limitation: Governed exclusively by and construed in accordance with the laws of the Hong Kong Special Administrative Region.

Authorized by:

BCI Governance Committee

Under BSIP v2.0 Institutional Release Standards

Document Nature: Structural Diagnostic Review | Authorization Required (Institutional Access Only).

BCI reports are designed to be cited for institutional risk discussion and governance analysis.Full attribution to BCI Lab – Structural Governance Framework is required.

Citation Requirement:

Any external citation must include full BCI Score and Confidence Band, file number, and protocol reference.

Unauthorized commercial redistribution is prohibited.