Document Ref: SIDR-2026-ROLEX-001-P

Audit Standard: BCI Structural Integrity Protocol V1.0

Structural Status Reading: Second-Order Liquidity Sovereignty / Institutionalized Value-Substitution

I. System Observation Statements

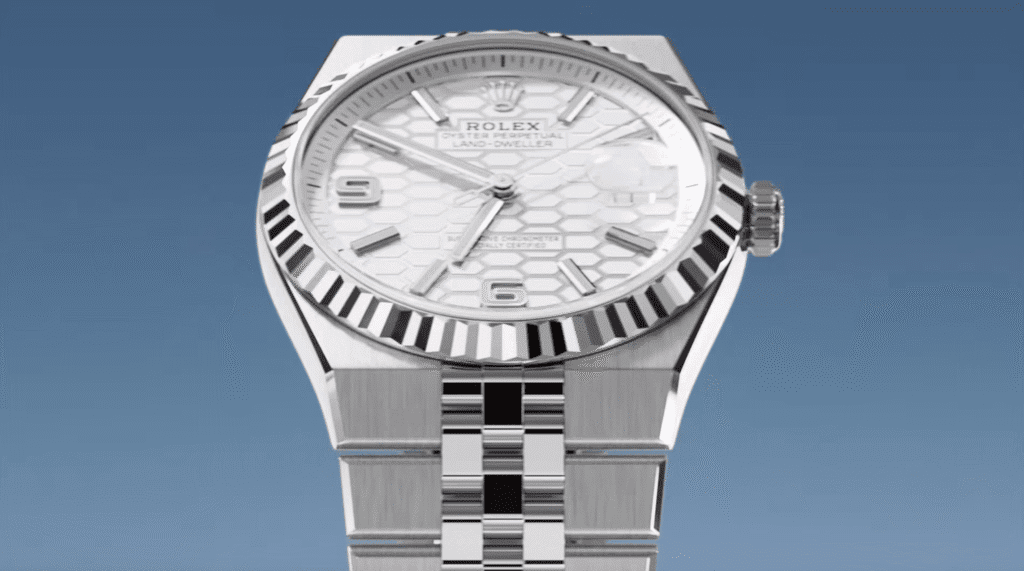

Within the BCI Structural Dynamics Framework, Rolex is characterized as a “Monetized Static Sovereignty” asset. Systemic readings indicate that the asset’s long-term structural stability derives from its role as a global value-anchoring instrument. It functions as a highly institutionalized value-substitution medium, recognized across economic cycles and jurisdictions.

Current observations identify a structural feedback loop between secondary-market volatility and primary-market narrative stability. The system observes that when external liquidity dynamics dominate public interpretation pathways, shifts in Perceptual Legibility (PL) may occur. However, the asset currently remains within the Sovereign Stability Range, sustained by an exceptionally resilient Temporal Structure

(TS^{n}).

BCI Institutional Matrix — Asset Structure Calibration

| Dimension | Research Range | Institutional Definition | Financial Mapping (Interpretive) |

| MT (Meaning Tension) | Elevated | Institutional trust and class consensus. | Goodwill stability & long-term premium. |

| PL (Perceptual Legibility) | Low–Mid | Symbolic clarity with access friction. | Inventory turnover & GM structure. |

| TS (Temporal Structure) | Elevated | Cross-cycle value-preservation capacity. | Inflation-hedging & discount-rate sensitivity. |

| ES (Energy State) | Elevated | High systemic self-repair & operating leverage. | Marketing efficiency & maintenance cost. |

II. Governance Option Descriptions

The following scenarios illustrate research-based structural hypotheses and the potential implications of external liquidity shifts:

- Path A: Structural Continuity (Equilibrium): Describes a state where liquidity dynamics and narrative frameworks remain in dynamic equilibrium. This path maintains the asset’s high structural stability and its role as a cross-cycle value anchor.

- Path B: Liquidity Disturbance (Legibility Spike): Describes a scenario where macroeconomic shifts induce external capital volatility. System modeling suggests a temporary increase in PL (Legibility) without immediate impairment to the core TS (Temporal Structure).

- Path C: Structural Stress Test (Decoupling): Describes a potential prolonged decoupling between symbolic value and market pricing logic. This scenario would require a reassessment of the transmission mechanics of the asset’s temporal structure.

[ 📥 DOWNLOAD FULL CATEGORY C REPORT ]

Document Nature: Scholarly Research · Non-Financial · Non-Actionable

Opinion Access: Authorized Institutional Password Required

BCI reports are designed to be cited for institutional risk discussion and governance analysis.Full attribution to BCI Lab – Structural Governance Framework is required.