[ BCI LAB | GLOBAL ASSET TOPOLOGY REVIEW – 2026 Q1 ]

File Code: SRR-2026-SYN-011-V3

Protocol: BCI Structural Integrity Protocol (BSIP) v2.0

Data Cutoff: 31 Jan 2026

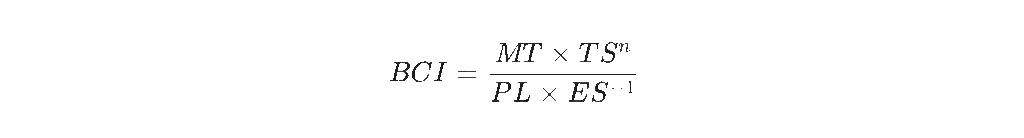

BCI variables are operationalized through repeatable structural diagnostics under BSIP v2.0, forming a protocol-based brand valuation framework rather than a narrative metaphor.

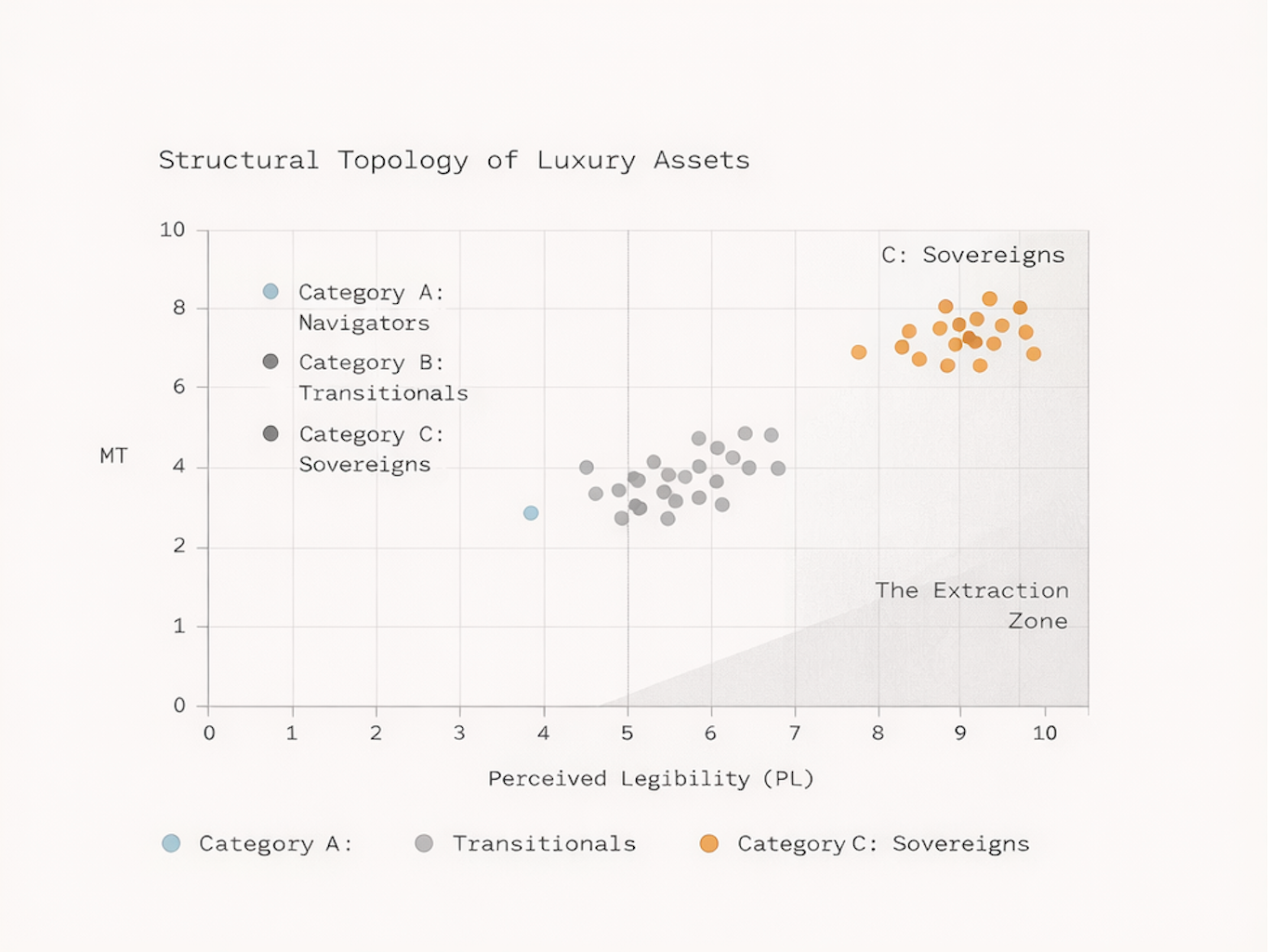

This review maps 15 global luxury assets across three structural categories under the BCI framework: Snapshot, Attribution, and Integrity.

The objective is not ranking.

It is structural resonance detection.

Methodological Boundary Notice

BCI structural coordinates are derived from internally calibrated diagnostic bands under BSIP v2.0. Scores represent relative positioning within the model’s defined symbolic domain and are not directly comparable to accounting-based valuation metrics or third-party rating systems.

The framework applies exclusively to organizations in which symbolic capital constitutes a material share of enterprise value (>30% as defined under BCI domain criteria).

Source: BCI Lab Proprietary Topology Simulation Model v2.0. Coordinates reflect normalized structural archetypes under defined model constraints.

[ AUDIT ADVISORY | CATEGORY A ]

-

Coordinate Context: The current MT/PL mapping reflects the Initial Encoding Baseline.

-

Diagnostic Note: Navigators are structurally governed to suppress PL (Legibility) to prevent symbolic dissipation. The low MT reading in this phase constitutes a “Latent Gravity State”—the system prioritizes narrative closure before scaling premium resonance.

I. The 2026 Structural Landscape

Three cross-category dynamics are increasingly visible in long-duration consumer franchises:

Meaning Encryption vs. Perceptual Inflation (MT vs. PL)

As social media compresses cognitive distance, elite assets are deliberately lowering Perceptual Legibility (PL) to preserve Meaning Tension (MT).

This is not an aesthetic preference. It is defensive capital allocation.

In structural terms, excessive PL expansion dilutes pricing inelasticity stored in belief.

Energy State Polarization (ES)

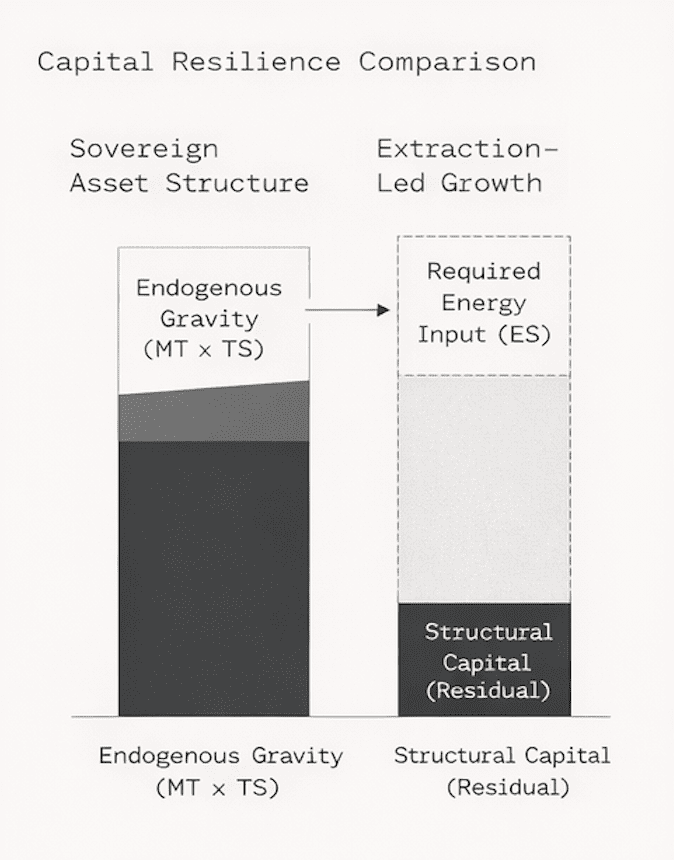

Assets with strong Temporal Structure (TSⁿ) demonstrate lower entropy under capital contraction cycles.

Where symbolic capital compounds intergenerationally, external energy input (ES) requirements decline.

In weaker systems, marketing intensity substitutes for gravity.

Single-Point Fragility

Concentration risk in narrative or hero-product dependency is rising.

Ultra-concentrated model architectures show nonlinear volatility expansion when demand rotation occurs.

In valuation language: terminal cash-flow durability becomes conditional, not assumed.

Synthetic Structural Indicators (2026 Q1)

Sector Aggregate:

MT: 8.85 — High plateau; governance focus on preventing aesthetic inflation

PL: 7.92 — Expanding; introduce calibrated cognitive friction to protect scarcity

TSⁿ: 8.30 — Gradual compounding; reinforce legal and physical craft sovereignty

ES: 7.45 — Cyclical contraction; reallocate energy toward high-margin subsystems

Cross-Category Structural Pressure Index (CSPI): Latent compression beneath stable surface readings.

II. Category Resonance Overview

Over a 5–10 year horizon, the dominant structural variable is not demand cyclicality but symbolic regeneration velocity. Systems unable to replenish MT at the rate PL expands will experience sovereignty decay before revenue deceleration becomes visible in reported earnings.

The following category mapping reflects structural archetype clustering under BCI’s topology model and does not constitute formal ratings, investment opinions, or integrity verdicts on individual brands.

Category A – Encoding Navigators (Illustrative Archetypes within Global Luxury Systems)

These assets demonstrate functional foundations transcribed into symbolic sovereignty.

The structural control variable is PL calibration.

Rimowa and Loewe sustain high recognition without collapsing into commodity exposure because MT depth anchors legibility.

Risk: cognitive saturation.

When PL remains structurally above 9.0, periodic MT regeneration becomes necessary to avoid diminishing ES efficiency.

Category B – Calibration Transitionals

These systems operate under narrative reallocation pressure.

The core challenge is MT continuity through leadership transition.

Where creative authorship converts into institutional heritage, TS decay remains contained.

Risk: cognitive decoupling.

High MT reserves with insufficient PL distribution create conversion inefficiency.

Governance question: how to expand circulation without sovereign dilution.

Category C – Systemic Sovereigns

These represent high-pressure structural environments.

Bulgari’s multi-category coupling and Hennessy’s ultra-long TSⁿ cycles approach industrial durability limits.

Risk: structural concentration.

In highly concentrated product architectures, ES intensity masks latent fragility.

In contrast, Cucinelli demonstrates that ethical capital can function as an MT stabilizer, reducing volatility sensitivity.

Certain systems continue to compound sovereignty through disciplined PL suppression and TS reinforcement, demonstrating that structural durability remains achievable under capital intensity.

III. Capital Market Bridge

Historical Validation Note

Retrospective analysis across 2016–2023 consumer cycles indicates that sustained MT compression preceded observable multiple contractions in a majority of sampled cases, with structural deterioration becoming visible 2–4 quarters before revenue deceleration.

These findings are derived from internal longitudinal diagnostics and serve as structural correlation observations rather than deterministic forecasts.

Under the BCI model:

Capital markets primarily discount observable earnings streams, while structural durability influences the long-duration assumptions embedded in terminal value modeling.

When PL acceleration outpaces MT regeneration, sustaining revenue requires exponential ES input.

Energy substitutes for gravity.

In discounted cash flow terms, this implies:

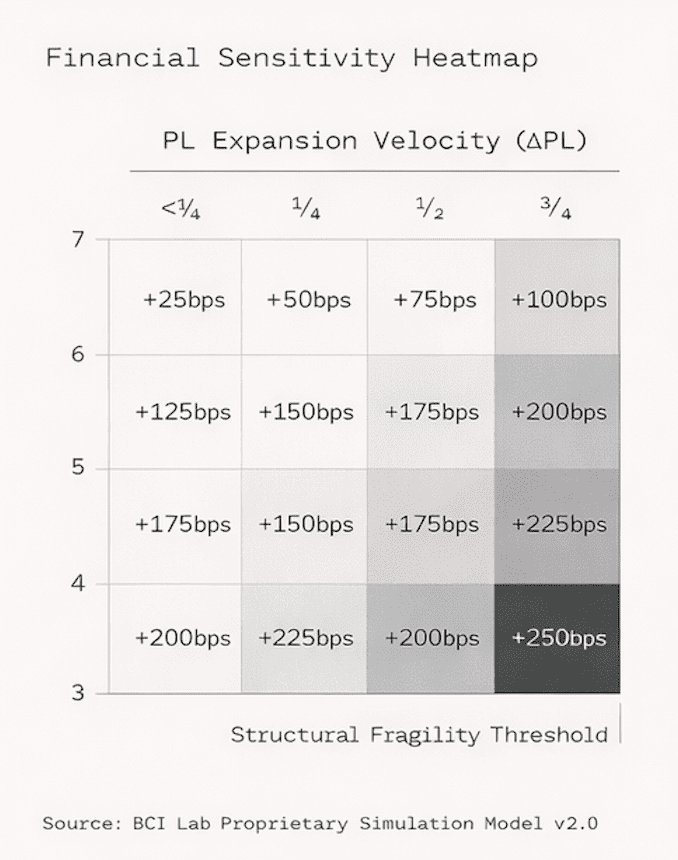

• Increased volatility in forward cash flows

• Compression of anti-cyclic resilience

• Justification for marginal widening of equity risk premium

Even a 100–150bps shift in discount rate assumptions materially alters terminal value in long-duration luxury assets.

In long-duration equities, structure is the hidden denominator. When MT regeneration weakens, discount rates adjust not because growth slows, but because durability assumptions erode.

The issue is not whether revenue is growing.

It is whether sovereignty is compounding.

Structural decay rarely appears in quarterly guidance.

Growth financed by stored symbolic capital is structurally different from growth generated by regenerative meaning density.

In physics, this is mechanical.

In governance, it is strategic.

In valuation, it is repricing.

IV. Institutional Positioning

Sensitivity outputs are scenario-based simulations under internally defined parameter shifts and do not represent market forecasts or pricing recommendations.

BCI Lab does not issue price targets.

We conduct intangible asset audits and structural configuration diagnostics in long-duration symbolic systems.

Structural attribution precedes financial repricing.

For boards and investment committees, the question is not velocity.

It is whether the growth vector preserves MT and TS, or consumes them.

Luxury assets rarely collapse from demand.

They fail when sovereignty is extracted faster than it regenerates.

The framework is cross-sector transferable to any system where pricing power is derived from symbolic density rather than functional utility.

Institutional Footer

Liability Layering & Disclaimers:

Non-Actionability: This diagnostic is strictly observational and does not constitute financial, management, or investment advice.

Regulatory Limitation Clause: This document does not constitute a credit rating, a securities analysis, or a valuation report.

Jurisdictional Limitation: This report is subject to interpretation exclusively under the laws and legal framework of the Hong Kong Special Administrative Region (HKSAR).

Download Guidance: Document Nature: Structural Diagnostic Review | Authorization Required (Institutional Access Only).

Citation Requirement: Any external citation must include the full BCI Score, Confidence Band, File Number, and Protocol Reference. Unauthorized commercial redistribution is prohibited.

Authorized by: BCI Governance Committee | Under BSIP v2.0 Institutional Release Standards.