Most financial models are blind to time.

Discounted cash flow can price risk — but it cannot see decay.

In the BCI Structural Dynamics framework, a brand is not a static label; it is a time-dependent energy system. The ability of an asset to resist entropy (disorder/decay) is not a marketing quality; it is a measurable structural variable we call Time Structure (TS).

For the institutional investor, the question is not How old is this brand? (History).

The question is What is the half-life of its premium? (Physics).

Today, we deconstruct The Calculus behind the TS variable—the exponent that powers the BCI Universal Equation:

1. The Variable: Defining Time Structure (TS)

Most consumer assets follow a Linear Decay Curve. A fast-fashion handbag or a high-performance smartphone loses value the moment it creates a transaction. Its relationship with time is Adversarial.

Sovereign assets — what we classify internally as Category A/C — possess a compound architecture. Their relationship with time is Symbiotic.

We define TS as:

The structural coefficient measures an asset’s resistance to temporal entropy. It quantifies the delta between current operational cash flow and intergenerational value retention.

2. The Calculus: How We Quantify It

We do not ask consumers what they feel.

We observe what survives.

This is semiotic physics.

The TS reading is derived from three proprietary sub-metrics that map directly to failure modes in consumer monopolies.

A. The Vintage Premium Slope (\Delta V_p)

We track the secondary market pricing of an asset’s deadstock (past iterations) relative to its current retail price.

- Negative Slope (Standard Asset): The 2020 model is cheaper than the 2026 model. (e.g., iPhone, Tesla). Technology decays.

- Positive Slope (Sovereign Asset): The 1990 model trades at a premium to the 2026 model. (e.g., Patek Philippe, Hermès).

- The Audit: If \Delta V_p turns flat or negative for a Heritage Brand, it is a leading indicator of Structural Integrity Failure. The asset has ceased to compound and has begun to transact.

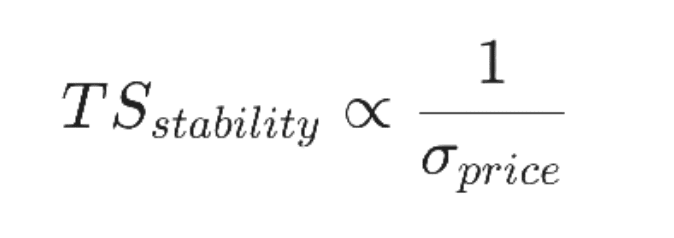

B. The Volatility Suppression Index (Vi)

We measure the asset’s price elasticity during macroeconomic downturns (e.g., 2008, 2020).

High TS assets act as Wealth Bunkers. Their value is decoupled from the immediate industrial cycle. If an asset’s secondary price correlates too closely with the S&P 500, its TS score is penalized. It is not a Sovereign Asset; it is merely a High-Beta Luxury Stock.

C. The Aesthetic Half-Life (T_{1/2})

We quantify the rate of Symbolic Obsolescence. How often must the asset change its form factor to generate revenue?

- Low TS: Requires seasonal reinvention (Fashion logic).

- High TS: Enforces static repetition (Icon logic).

- The Governance Risk: When a management team accelerates aesthetic changes to meet quarterly targets, they shorten their own Time Structure effectively. They trade TS (Long-term Exponent) for PL (Short-term Liquidity).

3. Financial Mapping: Why This Matters to the Board

For the CFO, the TS reading is not theoretical. It is the structural justification for the Cost of Capital.

- High TS (9.0+) = Lower Discount Rate. The cash flows are structurally protected from competitive erosion. The asset behaves like a Perpetual Bond.

- Low TS (<5.0) = High Reinvestment Risk. The company must constantly spend heavily on R&D and Marketing just to maintain the same price point.

The Observation:

Many modern Luxury conglomerates are structurally Low TS entities masquerading as High TS assets. They are dependent on high-velocity trend cycles (Speed) rather than compounding gravity (Time).

This is not a moral judgment. It is a Failure Mode Prediction.

4. The Wealth of Slowness

In a high-velocity economy, Slowness is usually an inefficiency.

But in Intangible Asset Structural Integrity Audits, Slowness—when engineered correctly—is a form of Monopoly Defense.

The goal of BCI is to identify which assets are merely old and which assets have successfully engineered a Time Structure that monetizes the passage of time itself.

This essay is part of the BCI Lab’s ongoing work on Time Structure and Intangible Asset Structural Integrity.