The Calculus IV: The Energy State (ES^{-1}) and the Physics of Sovereign Waste

Abstract:

In the final installment of our “Structural Dynamics” series, BCI Lab deconstructs the fourth and most counterintuitive variable of our valuation model: Energy State (ES). While traditional GAAP accounting rewards operational efficiency, the BCI Structural Integrity Audit treats “frictionless efficiency” as a high-entropy failure mode for sovereign assets. We posit that for luxury monopolies, value is stored in specific, inefficient energy exchanges.

01. The Efficiency Paradox in Asset Pricing

If you ask a McKinsey consultant to audit a heritage brand, they will look for “redundancies.” They will optimize the supply chain, streamline the narrative, and accelerate the “time-to-market.”

If you ask a physicist to audit a closed system, they will tell you that maximizing flow efficiency minimizes internal structure.

At BCI Lab, we define Intangible Asset Structural Integrity not by how fast an asset moves, but by how much “Meaning Tension” (MT) it can hold without dissipating. This brings us to the final variable in our equation: Energy State (ES), or more precisely, its inverse function in our pricing model:

Why inverse? Because in the realm of Sovereign Assets (Category C), Efficiency = Commoditization.

When a brand eliminates the friction of craftsmanship, the friction of acquisition (waitlists), or the friction of comprehension (poetic complexity), it increases its “velocity” but degrades its “mass.” It moves from a state of Nourishment (high internal energy retention) to a state of Extraction (burning structural capital for cash flow).

02. Defining the Variable: Nourishing vs. Extracting

In our Predicting Failure Modes in Consumer Monopolies protocol, we measure ES by auditing the directional flow of energy between the system and its participants (users/clients).

We categorize Asset Energy States into three thermodynamic phases:

Phase A: The Nourishing State (Negative Entropy)

- Physics: The system puts more energy into the object than the market demands.

- Example: Hermès refusing to use a distinct leather hide because of a microscopic imperfection invisible to the naked eye.

- Audit Reading: This is “Sovereign Inefficiency.” The wasted material is not a loss; it is a Structural Insurance Premium. It signals to the market that the brand’s internal standard is higher than the external pricing mechanism.

- Financial Consequence: High gross margins, low velocity, infinite duration (TS^n).

Phase B: The Balanced State (Equilibrium)

- Physics: The energy input roughly matches the commercial output.

- Example: BMW 5 Series. High-quality engineering, but every feature is calculated for a specific market return.

- Audit Reading: Functional Utility. The asset is stable but lacks the “irrational surplus” required for sovereignty.

Phase C: The Extracting State (Entropy Acceleration)

- Physics: The system extracts value from past structural deposits (TS) to fuel current liquidity (PL), without replenishing the core.

- Example: A heritage fashion house licensing its name to eyewear conglomerates or launching a “diffusion line.”

- Audit Reading: This is a Structural Short. The brand is liquidating its Meaning Tension. It looks profitable on a P&L sheet (high efficiency), but physically, the asset is cooling down. The system exhibits characteristics consistent with late-stage extractive dynamics.

03. The Calculus of Friction: Quantifying ES^{-1}

Energy State (ES) is one of the four core variables in BCI’s Intangible Asset Structural Integrity Audit framework.

How do we quantify Brand Equity via Semiotic Physics? We don’t use surveys. We audit “Systemic Friction.”

The BCI algorithm assigns a higher valuation multiple to assets that maintain Intentional Friction. We calculate ES through the following “Waste Ratios”:

-

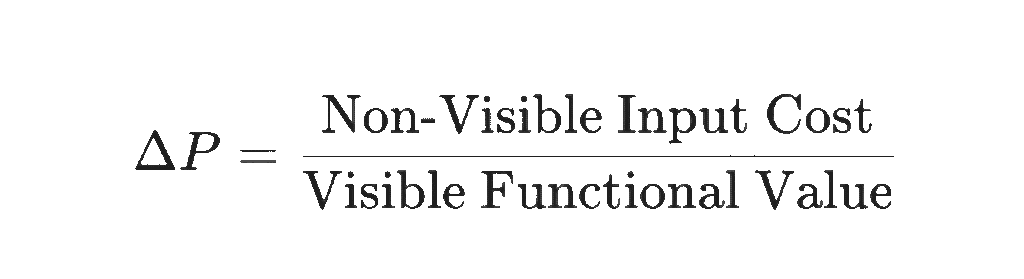

The Production Friction Ratio (\Delta P)

- Audit Check: Does the brand spend money on details that the consumer cannot see? (e.g., the finishing on the inside of a Patek Philippe case back).

- Interpretation: If \Delta P \to 0, the asset is a commodity. If \Delta P is high, the asset is a sovereign store of value.

2. The Acquisition Friction Ratio (\Delta A)

- Audit Check: Is the difficulty of obtaining the asset purely financial (price), or is it temporal/social (waiting lists, vetting)?

- Interpretation: Pure financial barriers are fragile (new money can always breach them). Temporal barriers (TS) are robust.

3. The Narrative Friction Ratio (\Delta N)

- Audit Check: Is the brand message instantly legible (PL high), or does it require decoding?

- Interpretation: “Click-through” optimized marketing is high-entropy. Poetry is low-entropy.

These ratios are normalized and aggregated within a proprietary scoring kernel.ΔN measures irreducibility.

04. Case Study: The Thermodynamic Audit of Fast Luxury

Let us apply this to a theoretical stress test.

Subject: Brand X (A High-Growth “Masstige” Conglomerate)

Observation: Brand X has optimized its supply chain. It uses AI to predict trends. It has reduced the “time-to-shelf” to 2 weeks. Its Operating Profit Margin is 35%.

GAAP View: A highly efficient, “Strong Buy” equity.

BCI Structural View:

- ES Reading: Highly Extractive. The system is converting all potential energy into kinetic energy (sales) instantly.

- Diagnosis: The asset has zero “Thermal Mass.” It cannot survive a market winter.

- Conclusion: The system exhibits characteristics consistent with late-stage extractive dynamics. The brand is not building equity; it is mining it.

Subject: Brand Y (A Sovereign Watchmaker)

Observation: Brand Y rejects 40% of its dials. It refuses to increase production despite demand. It spends 6 months training an artisan for a single task.

GAAP View: Inefficient. Costly. “Leaving money on the table.”

BCI Structural View:

- ES Reading: Nourishing. The “waste” is actually the Storage of Value.

- Diagnosis: Structural Integrity is SR-AAA. The inefficiency creates the scarcity that underpins the pricing power.

05. Governance Implication: The Right to Waste

For the Board of Directors and Capital Allocators reading this:

The most dangerous decision you can make for a Sovereign Asset is to “optimize” it.

When you hear proposals to “streamline” the artisanal process, or “democratize” access to boost quarterly revenue, you are hearing a proposal to increase Entropy.

In the physics of intangible assets, Friction is not a bug. It is the product.

Your duty as a steward of a Category C asset is not to maximize flow, but to defend the Energy State. You must protect the “Right to Waste”—the right to spend time, material, and thought on things that do not have an immediate ROI, but which constitute the gravity (MT) that holds the system together.

BCI Lab | Institutional Note

This article is part of the “Quantifying Brand Equity via Semiotic Physics” series. BCI Lab provides Intangible Asset Structural Integrity Audits for Sovereign Brands and Family Offices.

Classification: Institutional Research Note

Intended Audience: Board Members, Capital Allocators, Family Offices

Scope Limitation: Not investment advice. Structural risk analysis only.

This paper examines the Energy State (ES) variable as defined in BCI Lab’s Intangible Asset Structural Integrity Audit, a four-variable governance framework used to assess long-term risk in (Sovereign) assets.

BCI does not claim brands obey physical laws. We claim that governance systems that ignore entropy-like effects fail in predictable ways.