Document Ref: BCI-SR-2026-LP-STRAT

Audit Standard: BCI-Sovereign-S1-2026

Structural Status Reading: Sovereign Cognitive Overload / High-Sensitivity Equilibrium

I. System Observation Statements

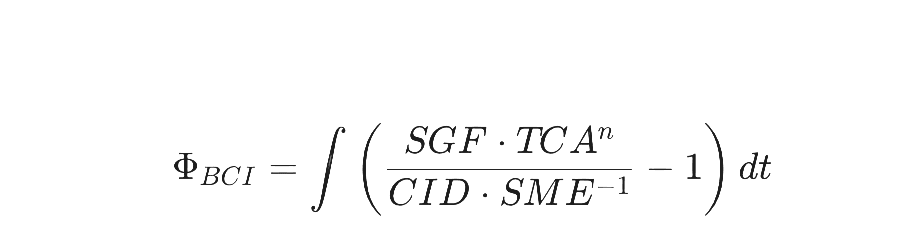

Based on the BCI V1.1 Structural Dynamics Protocol, Loro Piana is exhibiting signs of “Cognitive Overload.” System sensors indicate that Perceptual Legibility (PL) has reached 9.0, suggesting that algorithmic ubiquity has significantly lowered the entry barriers to brand logic.

While Time Structure (TS) remains resilient at 9.5 due to a physical monopoly over core raw materials (e.g., Vicuña), the volatility in Meaning Tension (MT) at 6.8 indicates a shift from “Niche Contractualism” toward “Mass Semantics”.

This creates a structural friction where hyper-legibility (PL) risks the premature liquidation of the temporal dividends provided by the $TS^n$ component.

BCI Structural Matrix — Current Readings

| Dimension | Reading | Institutional Mapping | Audit Observation |

| MT (Meaning Tension) | 6.8 | Intangible Assets (Goodwill) | Symbolic consensus is migrating toward Mass Semantics. |

| PL (Perceptual Legibility) | 9.0 | CAC / Premium Coefficient | Entry barriers have been structurally compromised by ubiquity. |

| TS (Time Structure) | 9.5 | Asset Decay Resistance | Core moat remains secure via physical raw material monopoly. |

| ES (Energy State) | 8.5 | Metabolic Efficiency | Elevated social resonance requiring stabilization. |

II. Governance Option Descriptions

The following pathways are observed for the stabilization of the asset’s sovereign integrity:

- Symbolic Protection Protocol: Describes a strategy of moderate exposure restriction in high-penetration markets to reconstruct “Sovereign Distance”. This option involves a “Regulated Growth Ceiling” (est. 8%-10% reduction in non-core spillover) to secure long-term absolute pricing power.

- Raw Material Sovereignty Reinforcement: Describes the reallocation of capital toward “Proprietary Craftsmanship Enclosures”. This path aims to increase the exponential power ($n$) of TS to neutralize premium erosion caused by cognitive saturation.

- Cognitive Gradient Management: Describes the implementation of “Multi-Tiered Access Mechanisms” and cognitive shielding for ultra-scarce collections. The observed objective is to revert the PL reading toward the safety threshold of 7.5 by restoring “Intellectual Friction”.

III. Scenario Tree Simulations

- Path Alpha (Sovereign Recovery): Under conditions of structural restraint, gross margins are observed to remain at peak levels with EV/EBITDA multiples maintained within the premier valuation tier.

- Path Beta (Growth Inertia): Allowing the “Quiet Luxury” signal to function purely as a growth lever leads to Sovereign Dilution. The valuation model faces pressure to downshift toward “Premium Apparel” multiples.

[ 🔒 AUTHORIZED ACCESS ONLY ]

Download Full BCI-SR-2026-LP-STRAT Report (PDF)

Institutional Grade | Authorized Personnel Only