I. The Governance Paradox

In traditional valuation, Brand Equity is a residual plug number—theGoodwill left over when tangible assets are subtracted from the acquisition price. It is treated as magic.

At BCI Lab, we reject magic. We operate on the premise that intangible value is a structural output of Meaning Tension (MT).

Most boards demandBetter Storytelling. This is a fundamental error. A sovereign asset does not tell stories (which implies fiction and effort); it possessesMythic Gravity (which implies physics and inevitability).

This methodology paper deconstructs MT, the variable that governs pricing elasticity. We demonstrate how to execute an Intangible Asset Structural Integrity Audit to measure the distance between a symbol’s utility and its price—a gap we callThe Sovereign Premium.

II. The Theorem: MT as Potential Energy

Defining the Variable

We define Meaning Tension (MT) as the elastic potential energy stored within a symbol. It is the force that holds theSignifier (the logo/product) apart from theSignified (the dream/identity).

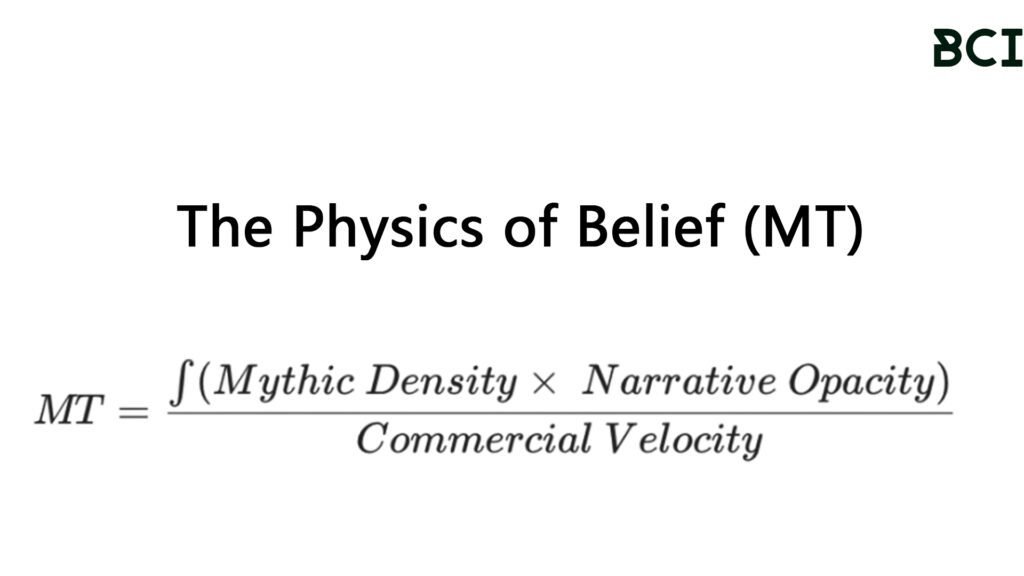

The BCI Structural Equation models this tension as:

(This formulation is a structural proxy, not a psychological claim.It models system behavior, not individual belief.)

- High MT (8.5 – 10.0): The Cult Object.

The gap between utility and price is extreme. The asset is heavy with meaning but light in availability. The narrative is dense, esoteric, and requires initiation. (e.g., Ferrari, Bitcoin in 2013, The Vatican).- Structural Consequence: Infinite Pricing Power. The price is not a cost; it is a tithe.

- Low MT (2.0 – 5.0): The Utility Provider.

The signifier collapses into the signified. A bag is just a container. A car is just transport.- Structural Consequence: Commodity Pricing. Margins compete with inflation.

The Structural Irony:

Commercial Velocity (sales volume) actively consumes Meaning Tension. Every transaction releases a tiny amount of the stored myth. If you sell too fast without reloading the myth, the tension snaps.

III. The Mechanism: Semiotic Physics

Quantifying Brand Equity via Semiotic Physics

How do we measureBelief without resorting to focus groups? We apply the principles of Semiotic Physics:

- Narrative Opacity (The Fog):

A sovereign asset must retain secrets. If a system is fully transparent, it has no depth. MT thrives on the unknown.- Audit Check: Does the brand explain itself? (Low MT) Or does it force you to interpret it? (High MT).

- Ritual Friction:

Meaning is generated through difficulty. The Birkin is not valuable because it is a leather bag; it is valuable because the process of obtaining it is a humiliation ritual. That friction generates MT.(humiliation ritual in terms of system-level, not moral judgment,as a structural initiation cost within sovereign systems) - Governance Rule: Convenience kills meaning.

BCI Observation: The most dangerous moment for a monopoly is when it tries to be understood by everyone. Understanding brings comfort, but it destroys awe.

IV. Financial Reconciliation: The Silence Premium

Auditing the Invisible

We translate MT directly into Predicting Failure Modes in Consumer Monopolies. When MT declines, financial statements show a specific pattern ofHollow Growth.

The MT Collapse Sequence:

- Stage 1: The Signal Decay. MT drops, but PL (Legibility) rises. The brand becomes hot but thin.

- Stage 2: The Efficiency Trap. Revenue peaks, but Marketing Ratio (Spend/Revenue) begins to climb. The asset is no longer pulling customers via gravity; it is pushing them via paid media.

- Stage 3: The Pricing Snap. The ability to raise prices without volume loss evaporates. The asset has become a commodity.

The Audit Metric:

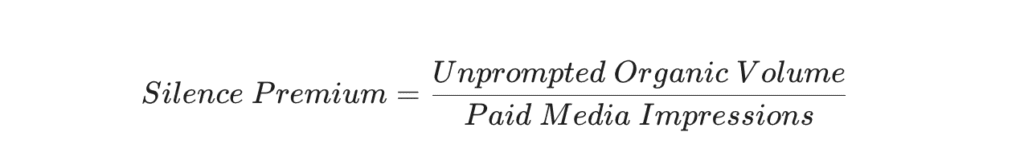

We look for theSilence Premium.

A high-MT asset generates massive volume with near-zero noise (e.g., Goyard does not advertise). A low-MT asset screams to be heard.

V. Failure Modes: TheDemystification Event

Case Study: The cost ofApproachable Luxury

Why do consumer monopolies fail? They fail because they mistake Expansion for Strength.

When a high-MT asset (like a heritage luxury house) launches aDiffusion Line or collaborates with a mass-market entity, they are trading Potential Energy (MT) for Kinetic Energy (Cash).

- Short Term: Revenue explodes.

- Long Term: TheTension is gone. The elastic band is slack. The asset is now just a product vendor.

Governance Mandate:

You cannot optimize a religion. You can only defend its dogmas.

VI. Institutional Protocol

FromStorytelling toMyth-Guarding

To the Asset Owner, the BCI instruction is absolute:

Do not tell a better story. Construct a deeper silence.

- Stop explaining the product benefits.

- Start encoding the cultural barriers.

- The BCI Mandate: If MT falls below 6.0, immediate Scarcity Shock is required. Cancel best-sellers. Close doors. Raise prices without explanation.

These are governance options, not prescriptions.

Application depends on ownership structure and fiduciary constraints.

In the physics of value, Ambiguity is the only non-depreciating asset.

BCI Lab | Structural Dynamics Division

Ref: The Physics of Belief (BCI-CALC-MT-2026)

Status: Public Release for Institutional Tier